More government purchase increases the demand for private output. Consequently, private employment rises in the short run. In the long run, there is no effect on private employment. The table below presents the effect of a permanent increase in general government purchase of goods and services. The public expenditure is increased permanently by 0.1 percent relative to the baseline. The increase corresponds to 1000 million kroner in the first year of the experiment in 2005 prices.(See experiment)

Table 1. The effect of a permanent increase in general government spending

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 42 | 283 | 373 | 367 | 352 | 488 | 721 | 879 | 950 | 978 |

| Pub. consumption | fCo | 1034 | 1042 | 1058 | 1074 | 1091 | 1176 | 1270 | 1371 | 1480 | 1597 |

| Investment | fI | 316 | 641 | 460 | 300 | 224 | 131 | 174 | 193 | 186 | 174 |

| Export | fE | -56 | -115 | -185 | -262 | -347 | -824 | -1255 | -1579 | -1790 | -1916 |

| Import | fM | 527 | 773 | 691 | 589 | 535 | 464 | 462 | 445 | 422 | 421 |

| GDP | fY | 844 | 1109 | 1053 | 933 | 833 | 573 | 523 | 505 | 497 | 511 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.76 | 1.26 | 1.40 | 1.36 | 1.24 | 0.56 | 0.19 | -0.01 | -0.13 | -0.15 |

| Unemployment | Ul | -0.41 | -0.64 | -0.70 | -0.67 | -0.61 | -0.27 | -0.09 | 0.00 | 0.06 | 0.08 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.04 | -0.03 | -0.03 | -0.03 | -0.04 | -0.07 | -0.08 | -0.10 | -0.11 | -0.12 |

| Priv. saving surplus | Tfn_hc/Y | 0.01 | -0.03 | -0.02 | -0.01 | -0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | -0.04 | -0.05 | -0.05 | -0.05 | -0.05 | -0.06 | -0.08 | -0.10 | -0.11 | -0.12 |

| Foreign receivables | Wnnb_e/Y | -0.07 | -0.14 | -0.20 | -0.25 | -0.29 | -0.53 | -0.81 | -1.13 | -1.45 | -1.78 |

| Bond debt | Wbd_os_z/Y | 0.02 | 0.03 | 0.06 | 0.08 | 0.11 | 0.33 | 0.60 | 0.89 | 1.19 | 1.49 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.08 | -0.08 | -0.07 | -0.06 | -0.05 | -0.02 | 0.00 | 0.01 | 0.01 | 0.02 |

| Labour intensity | hq/fX | -0.06 | -0.05 | -0.04 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 |

| User cost | uim | 0.00 | 0.01 | 0.02 | 0.03 | 0.04 | 0.07 | 0.08 | 0.08 | 0.08 | 0.08 |

| Wage | lna | 0.01 | 0.03 | 0.06 | 0.08 | 0.10 | 0.18 | 0.21 | 0.22 | 0.21 | 0.20 |

| Consumption price | pcp | 0.00 | 0.01 | 0.02 | 0.03 | 0.04 | 0.08 | 0.10 | 0.11 | 0.11 | 0.11 |

| Terms of trade | bpe | 0.00 | 0.01 | 0.02 | 0.02 | 0.03 | 0.05 | 0.06 | 0.06 | 0.06 | 0.06 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.03 | -0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 |

| Wage share | byw | -0.01 | 0.00 | 0.01 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.02 | 0.02 |

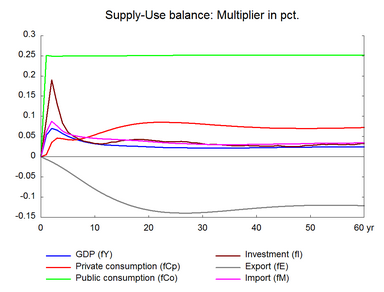

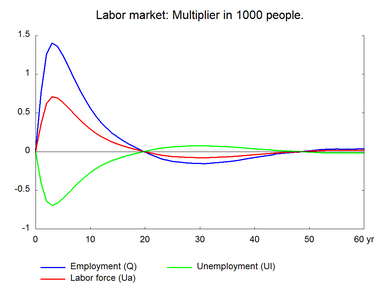

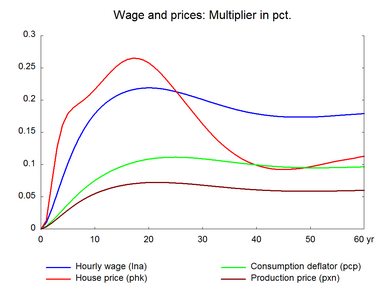

The immediate effect of an increase in government purchase of goods and services is that total demand rises. The increased demand is met partly through domestic production and partly through imports. The expansion in domestic economic activity raises private sector employment and lowers unemployment. The lower unemployment rate pushes prices and wages upward and reduces competitiveness. The lower competitiveness makes the market share of exports fall and the market share of imports rise, which reduces the positive effect on domestic production. Eventually, the effect on employment disappears and employment returns to its baseline. The long run effect on unemployment is also zero reflecting that the permanent increase in wages and prices deteriorates competitiveness and crowds out any impact on employment. This is the wage-driven crowding out process in ADAM.

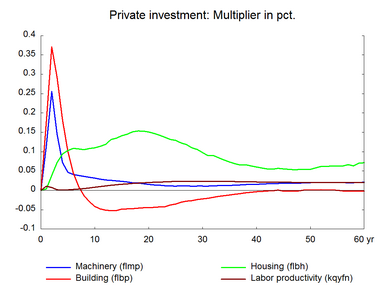

The short run effect is closely related with the Keynesian income multiplier. The income multiplier refers to the final change in income as compared to the injection of capital deposits or investments which originally fueled the growth. It is usually used as a measurement of the effects of government spending on income. In the present experiment, the income multiplier can be seen as the ratio between the effects on final demand and the change in government purchase of goods and services. In a closed economy, the multiplier for domestic demand is larger than one because the exogenous increase in government purchase of goods and services creates additional domestic demand in the form of more private investment and larger private consumption. However, the ADAM multiplier for GDP remains less than one because higher demand triggers not only GDP but also imports, see ADAM book for further discussion.

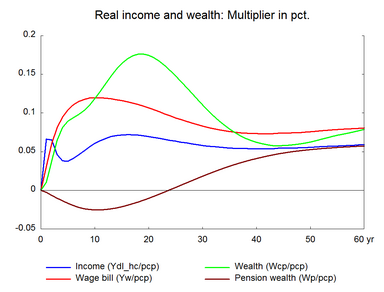

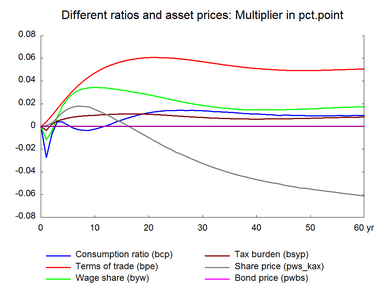

Wages and domestic prices increase in the medium and long run. But not equally. Prices adjust gradually to total production costs, which includes more than wages. Imported goods and services are for instance part of production costs. As the prices of imported goods are unchanged, prices increase less than wages. This results in a permanent positive effect on real wages, real income and private consumption. The long-term macro-consumption function in ADAM relates consumption to income and wealth and ensures that private consumption, real income and real wealth attain the same growth rate in the long run. Whenever real wages and real disposable income change permanently, private consumption changes. Increased public spending creates a permanent positive real wage effect. Thus the composition of GDP changes permanently towards higher public and private consumption and lower net exports relative to the baseline. That is, the composition of aggregate demand shifts from exports toward domestic consumption and investment and the composition of aggregate supply shifts from domestic production to imports.

The real wage effect also translates into a long-run effect on terms of trade. The positive change in the real wage increases domestic demand and reduces foreign demand. In the new equilibrium employment returns to its baseline while wages and prices increase permanently, which results in a permanent change in the long-run terms of trade.

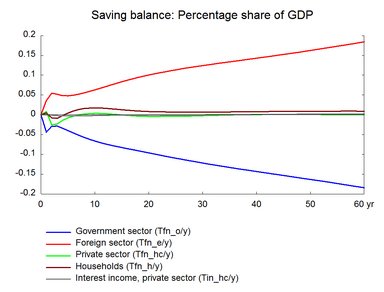

The consumption equation stabilizes the saving surplus of the private sector in the long run. Thus the private sector saving surplus returns to its baseline. In contrast, the government budget balance and the balance of payments become negative in the long run. This reflects the absence of an automatic fiscal reaction. If the higher public consumptions are financed by, for example, higher income taxes, there would be no permanent positive effect on private consumption, for a balanced budget experiment see section 18.

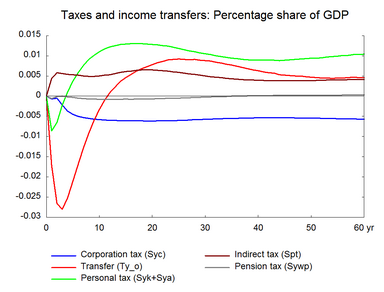

Figure 1. The effect of a permanent increase in general government spending