Increasing the labor supply has a positive effect on the public savings balance. The additional public savings can be used to increase spending or income tax rates can be reduced to create expansionary effects in the economy. Table 19 presents the effect of a permanent increase in labor supply accompanied by a permanent decrease in income tax rates. The number of people in early retirement scheme is reduced by 10000 and at the same time the central government income tax rates are reduced permanently by 2.3 percent to balance the public budget in the long run. (See experiment)

Table 19. The effect of a permanent increase in labor supply, balanced budget

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 1230 | 2592 | 3470 | 3915 | 4065 | 3452 | 2876 | 2650 | 2655 | 2869 |

| Pub. consumption | fCo | -13 | -31 | -43 | -49 | -52 | -53 | -55 | -63 | -74 | -84 |

| Investment | fI | 587 | 1677 | 2443 | 2744 | 2815 | 2146 | 1455 | 1281 | 1394 | 1601 |

| Export | fE | 230 | 466 | 702 | 942 | 1184 | 2256 | 3256 | 4316 | 5304 | 6068 |

| Import | fM | 735 | 1717 | 2324 | 2542 | 2569 | 2125 | 1935 | 2124 | 2476 | 2869 |

| GDP | fY | 1282 | 2924 | 4139 | 4877 | 5295 | 5511 | 5434 | 5882 | 6601 | 7361 |

| 1000 Persons | |||||||||||

| Employment | Q | 1.18 | 3.13 | 5.01 | 6.48 | 7.51 | 8.62 | 8.19 | 8.45 | 9.01 | 9.48 |

| Unemployment | Ul | 4.69 | 3.30 | 2.37 | 1.67 | 1.18 | 0.68 | 0.89 | 0.76 | 0.48 | 0.25 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.18 | -0.13 | -0.07 | -0.02 | 0.01 | 0.02 | -0.01 | -0.02 | -0.01 | 0.00 |

| Priv. saving surplus | Tfn_hc/Y | 0.13 | 0.02 | -0.07 | -0.13 | -0.16 | -0.11 | -0.04 | -0.01 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | -0.04 | -0.11 | -0.14 | -0.15 | -0.15 | -0.09 | -0.05 | -0.03 | -0.01 | 0.00 |

| Foreign receivables | Wnnb_e/Y | -0.04 | -0.17 | -0.32 | -0.47 | -0.61 | -1.03 | -1.12 | -1.07 | -0.96 | -0.83 |

| Bond debt | Wbd_os_z/Y | 0.16 | 0.26 | 0.31 | 0.31 | 0.29 | 0.13 | 0.12 | 0.16 | 0.16 | 0.11 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.07 | -0.14 | -0.17 | -0.18 | -0.16 | -0.04 | 0.02 | 0.00 | -0.03 | -0.05 |

| Labour intensity | hq/fX | -0.03 | -0.06 | -0.06 | -0.05 | -0.04 | -0.01 | -0.01 | -0.02 | -0.02 | -0.01 |

| User cost | uim | -0.05 | -0.08 | -0.10 | -0.11 | -0.12 | -0.16 | -0.19 | -0.23 | -0.25 | -0.26 |

| Wage | lna | -0.11 | -0.23 | -0.31 | -0.37 | -0.40 | -0.48 | -0.56 | -0.66 | -0.71 | -0.71 |

| Consumption price | pcp | -0.05 | -0.09 | -0.11 | -0.14 | -0.15 | -0.19 | -0.24 | -0.29 | -0.33 | -0.35 |

| Terms of trade | bpe | -0.03 | -0.06 | -0.07 | -0.09 | -0.09 | -0.12 | -0.14 | -0.17 | -0.18 | -0.19 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.14 | -0.06 | 0.02 | 0.07 | 0.10 | 0.08 | 0.03 | 0.00 | -0.01 | -0.01 |

| Wage share | byw | -0.05 | -0.09 | -0.11 | -0.11 | -0.10 | -0.08 | -0.10 | -0.11 | -0.11 | -0.10 |

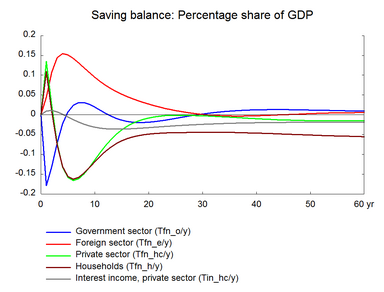

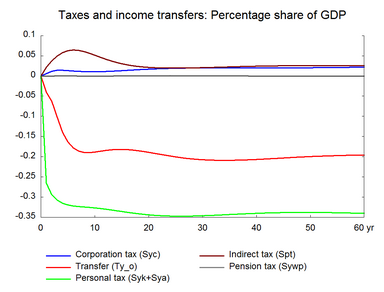

Compared to section 10, where labor supply increases without changes in the income tax rates, there are two opposing effects on public saving balance. We reduce the number of people outside the labor force receiving transfers from the government and this will have a positive impact on public savings as expenditures on transfers fall. At the same time the lower income tax rates reduce government revenues and public savings fall. In the short run, the negative effect dominates and public savings deteriorate but in the long term public debt as a ratio of GDP remains unchanged.

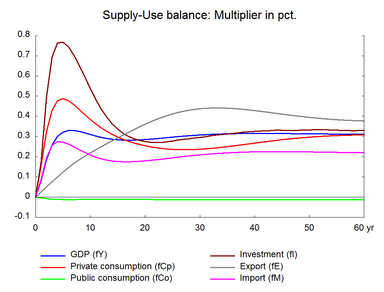

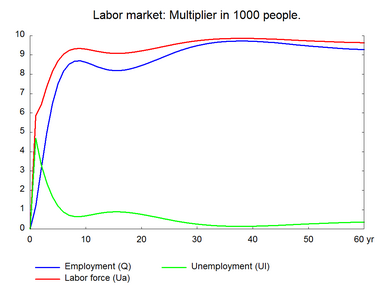

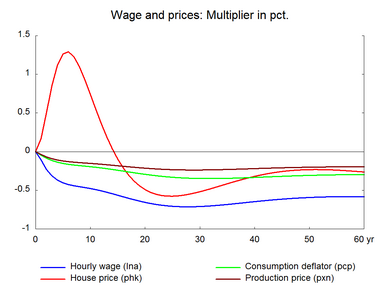

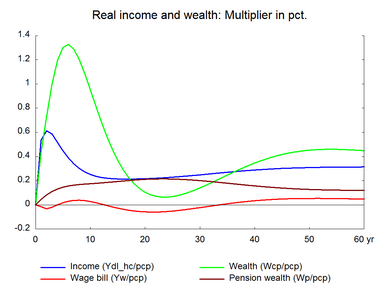

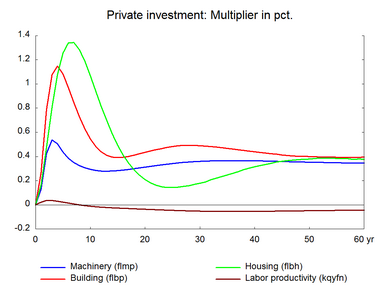

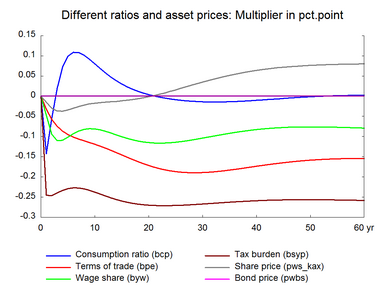

The higher labor supply is not automatically employed, so unemployment increases immediately. The higher unemployment exerts a downward pressure on wages and prices, which improves competitiveness. Accordingly, exports start to expand so production and employment increase. The expansionary effect is reinforced by the higher private consumption, which peaks after five years. The higher consumption reflects that the lower income tax rates increase disposable income. The stronger domestic demand makes unemployment fall more sharply compared to section 10. Employment increases until the additional labor force is employed and the rate of unemployment returns to the baseline. The higher production increases investments permanently. Imports also increase to meet the higher domestic demand.

In the long run, the need for higher competitiveness and lower wages moderates the increase in private consumption. The initial consumption boom raises the demand for housing, and housing investment and house price increase, and the higher housing wealth in turn stimulates private consumption. The initial expansion of the housing capital is stronger than the long run effect, and the excess supply of houses reduces house price and investment in housing undergoes a negative adjustment process before the housing market reaches equilibrium.

Figure 19. The effect of a permanent increase in labor supply, balanced budget