Here the efficiency of capital and labor is increased, which leads to a fall in the demand for both factors. The experiment produces a general reduction in production costs, therefore, a long run gain in foreign trade and domestic production.

The efficiency of labor and capital is permanently raised by 1 percent. (See experiment)

Table 14a. The effect of a permanent increase in labor and capital efficiency

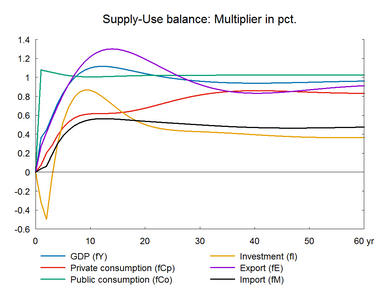

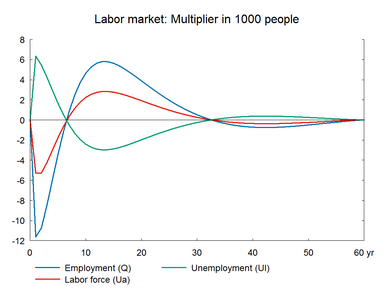

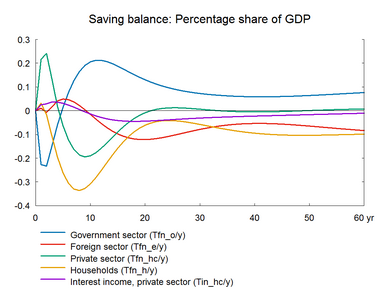

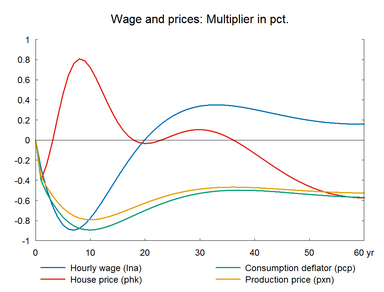

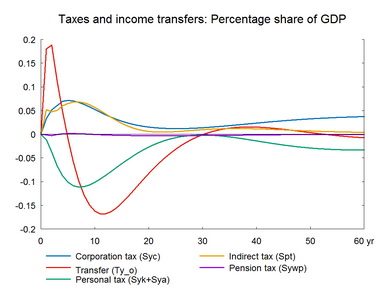

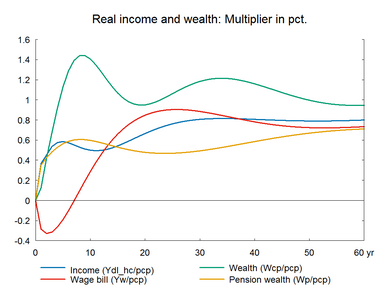

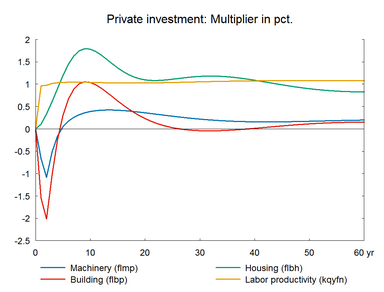

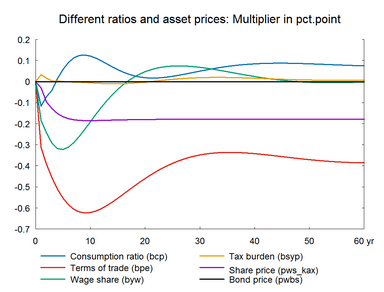

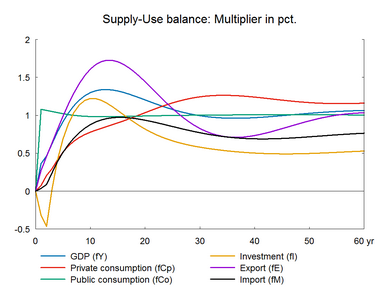

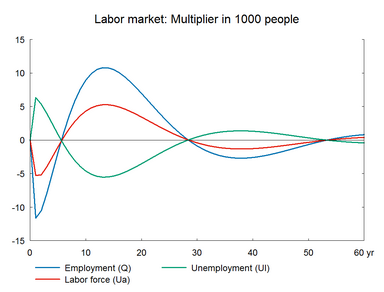

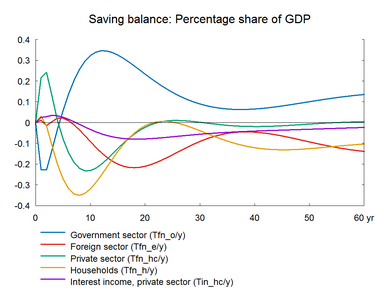

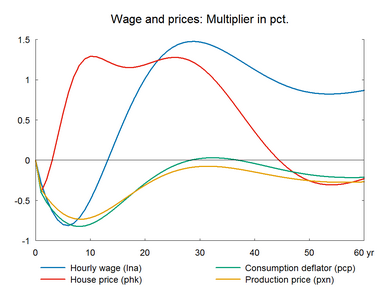

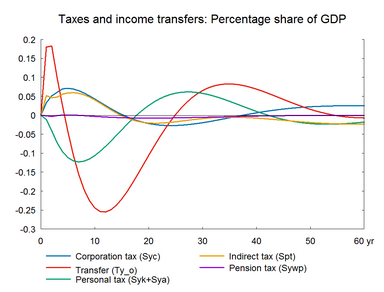

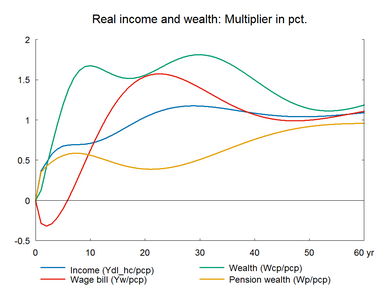

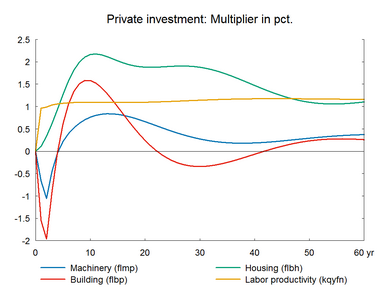

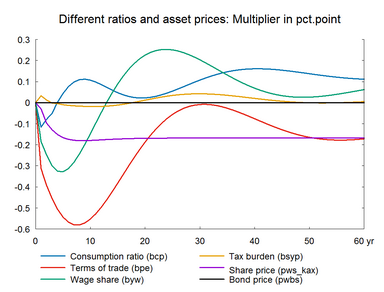

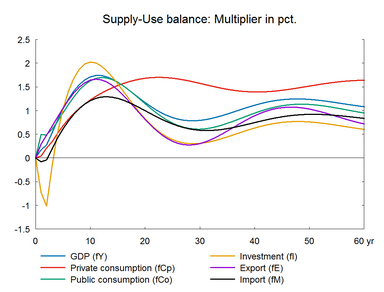

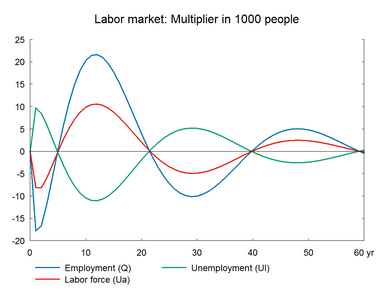

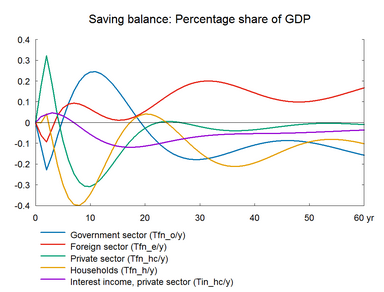

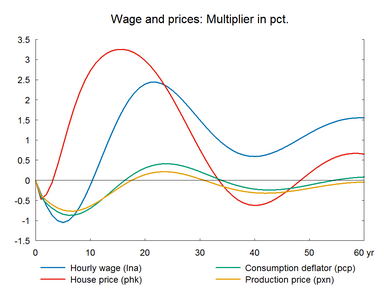

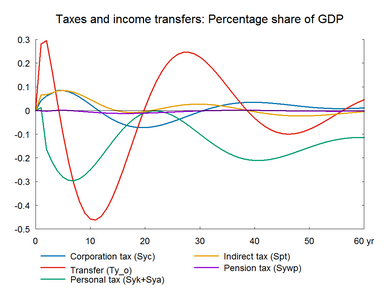

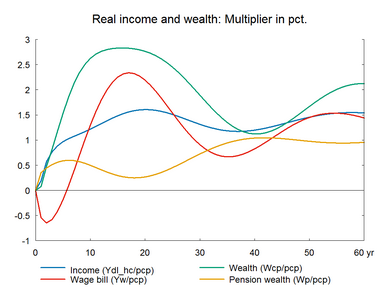

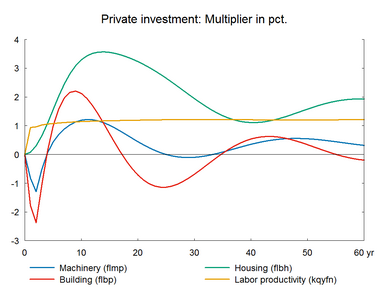

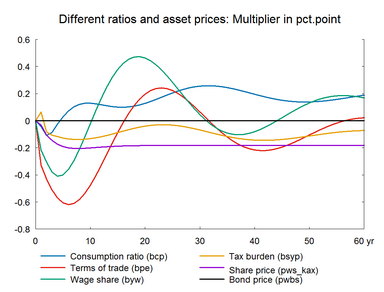

Higher efficiency of labor and capital means that both factor inputs can be reduced, consequently investment and employment fall in the short term. The fall, particularly in machinery investment, reduces imports and depreciation, which increases gross operating surplus. As factors efficiency increases prices fall and net exports increase without relying on change in wages. Higher net exports increase production and employment. This offsets the initial fall in employment created by the increase in labor efficiency.

The initial fall in employment pushes wages and prices downward. This improves competitiveness and induce exports to rise even more. As in the previous experiment, the combined effect of higher efficiency and lower wages means that the short-term decrease in factor utilization disappears relatively quickly and the initial negative impact on employment is reversed quickly. In the long term, capital intensity and labor intensity fall by approximately 1 percent, excluding the housing sector.

There is a small positive impact on private consumption in the long run, due to the positive impact on real disposable income, which is stimulated as the higher productivity increases the real income of transfer recipients. The public budget improves in the long term.

Figure 14a. The effect of a permanent increase in labor and capital efficiency

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The experiment in section A is repeated accompanied by improved export performance.(See experiment)

Table 14b. The effect of a permanent increase in labor and capital efficiency, with supply effects

Figure 14b. The effect of a permanent increase in labor and capital efficiency, with supply effects

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The experiment in section B is repeated, where the income tax rates are reduced to balance the public budget.(See experiment)

Table 14c. The effect of a permanent increase in labor and capital efficiency, with supply effects, balanced budget

Figure 14c. The effect of a permanent increase in labor and capital efficiency, balanced budget

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||